iowa capital gains tax calculator

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. You are able to use our Iowa State Tax Calculator to calculate your total tax costs in the tax year 202122.

The Ultimate Crypto Tax Guide 2020 Cryptotrader Tax In 2021 Tax Guide Cryptocurrency Cryptocurrency Trading

Moreover the deduction could not exceed 17500 for the tax year.

. The capital gains deduction has a fairly brief history on the Iowa 1040 Individual Income Tax Form. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. Taxes capital gains as income.

As of 2021 the long-term capital gains tax is typically either zero 15 or 20 percent depending upon your tax bracket. The cutoff for not owing any capital gains tax is now 40400 for individuals and 80800 for married couples filing jointly. Our capital gains tax calculator can provide your tax rate for capital gains.

See Tax Case Study. Our calculator has been specially developed in order to provide the users of the calculator with not only how. 2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high taxes on capital gains too. Iowa allows taxpayers to deduct federal income taxes from their state taxable income.

At tax time TurboTax Premier will guide you through your investment transactions allow you to automatically import up to 10000 stock transactions at once and figure out your gains and losses. Up to 41676 41677 - 459751Over 459751Married Filing Jointly. Calculate your estimated capital gains tax liability with the following calculator.

Iowa is a somewhat different story. The capital gains deduction has a fairly brief history on the Iowa 1040. Beyond 445850 for individuals and 501600 for married couples the 20 tax rate will apply on all.

Iowa Form 100B - Iowa Capital Gain Deduction Real. Both long- and short-term capital gains are taxed at the full Iowa income tax rates. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Long-Term Capital Gains Tax Rates. The current statutes rules and regulations are legally controlling. You will be able to add more details like itemized deductions tax credits capital gains and more.

Not all states impose a state tax on capital gains. Iowa has a cigarette tax of 136 per pack. Iowa Income Tax Table Tax Bracket Single Tax Bracket Couple Marginal Tax Rate.

Iowa Capital Gains Tax. In fact the same income tax rates apply to all Iowa taxable income whether stemming from ordinary income or a capital gain. Australia Corporation Capital Gains Tax Tables in 2022.

Additional State Capital Gains Tax Information for Iowa. The rate reaches 715 at maximum. The Combined Rate accounts for Federal State and Local tax rates on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which results in a tax rate increase of 118 percent.

Should the Department request it the information on the Capital Gain Deduction Checklist will be needed to verify whether you qualify for the deduction. Iowa Form 100C - Iowa Capital Gain Deduction Real Property Used in a Non-Farm Business. Capital Gains Taxes on Property.

Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years. Taxes capital gains as income and the rate reaches a maximum of 985. New Hampshire doesnt tax income but does tax dividends and interest.

52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. The 15 rate applies to individual earners between 40401 and 445850 and married couples earning 80801 to 501600. Your household income location filing status and number of personal exemptions.

Cedar Rapids Des Moines Iowa City. You must complete the applicable IA 100 form to make a claim to the Iowa capital gain deduction on your return. Capital GAINS Tax.

The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Toll Free 8773731031 Fax 8777797427. IRS will charge you tax on the gains.

Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. Capital Gain Tax Rate. Enter 100 of any capital gain or loss as reported on line 13 of your federal 1040.

Up to 83351 83352 - 517201Over 517201. Estimated Capital Gains Tax. Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet two stiff tests.

Capital gains tax rates on most assets held for a year or less correspond to. This is the instruction given. Filing Status 0 Rate 15 Rate 20 Rate.

Companies with a turnover greater than 5000000000. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. For sales made on or after January 1 1990 Iowa taxpayers could claim a 45 deduction on qualifying capital gains as specified in a.

The capital gain tax calculator is a quick way to compute the capital gains tax for the tax years 2022 filing in 2023and 2021. Please remember that the income tax code is very. Consequently Iowa would tax the capital gain from a typical stock sale at a rate of 898 percent the rate that applies to an individuals.

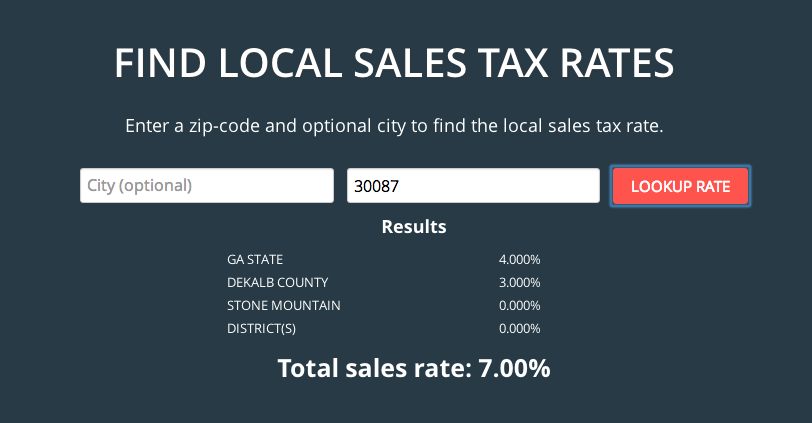

State Tax Rate ex. Capital gains taxes only apply to long-term capital gains. You can also connect live via one way video to a TurboTax Live Premier tax expert with an average 12 years.

The real estate has to have been held for ten years and. When a landowner dies the basis is automatically reset to the current fair market value at the time of death. Tax Information Sheet Launch Iowa Income Tax Calculator 1.

CPEC1031 of Iowa provides qualified intermediary services throughout the state of Iowa including. Iowa has a unique state tax break for a limited set of capital gains. 20 Maximum Capital Gains Tax - A new capital gains tax rate for capital gains income over the highest tax bracket 450000 for MFJ We have also added full support for calculating payroll taxes Social Security and.

New Jersey taxes capital. The calculator on this page is designed to help you estimate your projected long-term capital gains tax obligation based on the income made from your assets as well as the nuances of your financial circumstances. Companies with a turnover less than 5000000000.

Im trying to figure out how much if at all do I have to pay for some long-term and short-term capital gains made in 2014 to the State of Iowa where I reside. As you know everything you own as personal or investments- like your home land or household furnishings shares stocks or bonds- will fall under the term capital asset. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

A Like-Kind Exchange with a conservation agency might help you protect land while deferring. A good capital gains calculator like ours takes both federal and state taxation into account.

Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Capital Gains Tax Calculator 2022 Casaplorer

2021 Capital Gains Tax Rates By State Smartasset

Llc Tax Calculator Definitive Small Business Tax Estimator

2021 Capital Gains Tax Rates By State Smartasset

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Capital Gains Tax Calculator 2021 Forbes Advisor

Quarterly Tax Calculator Calculate Estimated Taxes

What Makes A Best In Class Email Marketer These Six Things Capital Gains Tax Capital Gain Life Insurance Policy

![]()

Iowa Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

Calculate Capital Gains Tax Capital Gains Tax Calculator

Capital Gains Tax Calculator Taxact Blog

State Tax Calculator Flash Sales 52 Off Www Emanagreen Com

Capital Gains Tax Calculator Capital Gains Tax Calculator Exchangeright

Capital Gains Tax Calculator Real Estate 1031 Exchange Capital Gains Tax Capital Gain What Is Capital

State Tax Calculator Flash Sales 52 Off Www Emanagreen Com

State Tax Calculator Flash Sales 52 Off Www Emanagreen Com

Smartasset S Iowa Paycheck Calculator Shows Your Hourly And Salary Income After Federal State And Local T Retirement Calculator Best Savings Account Financial